The Macro: Everyone Wants Startup Intelligence, Nobody Wants to Do the Work to Get It

The startup intelligence market is bloated with noise and starving for signal. The MarTech sector is projected to grow from roughly $558 billion in 2025 to nearly $2.9 trillion by 2034, according to Precedence Research. That number is so large it almost loses meaning. What it does tell you is that an enormous amount of money is chasing better data about what’s actually working.

The problem is that most of the data is garbage.

Self-reported MRR figures on Twitter. Founder announcements optimized for fundraising optics. “We crossed $X ARR” posts that omit the timeline, the churn rate, and the fact that three of those customers are the founder’s cousins. Anyone who’s spent more than six months watching startups knows this is a chronic credibility problem.

There are tools in this space. Crunchbase and PitchBook track funding rounds, not revenue velocity. Y Combinator’s public batch data is useful but scoped to their portfolio. What nobody has managed to do cleanly is surface revenue growth in real time, at the indie and micro-SaaS tier, with anything resembling verification. That’s the gap Unicorne is pointing at. Whether they actually fill it depends on things I’ll get to in a minute.

The timing is at least plausible. Payment infrastructure like Stripe and RevenueCat has matured enough that API-level access to revenue data is genuinely feasible in ways it wasn’t five years ago. The question is whether enough startups will consent to being ranked by it.

The Micro: What It Actually Does (and the One Thing Worth Watching)

Unicorne pulls verified revenue data from Stripe, Paddle, and RevenueCat via read-only API connections. No self-reported numbers. That’s the only interesting sentence in the product description and also, essentially, the entire product.

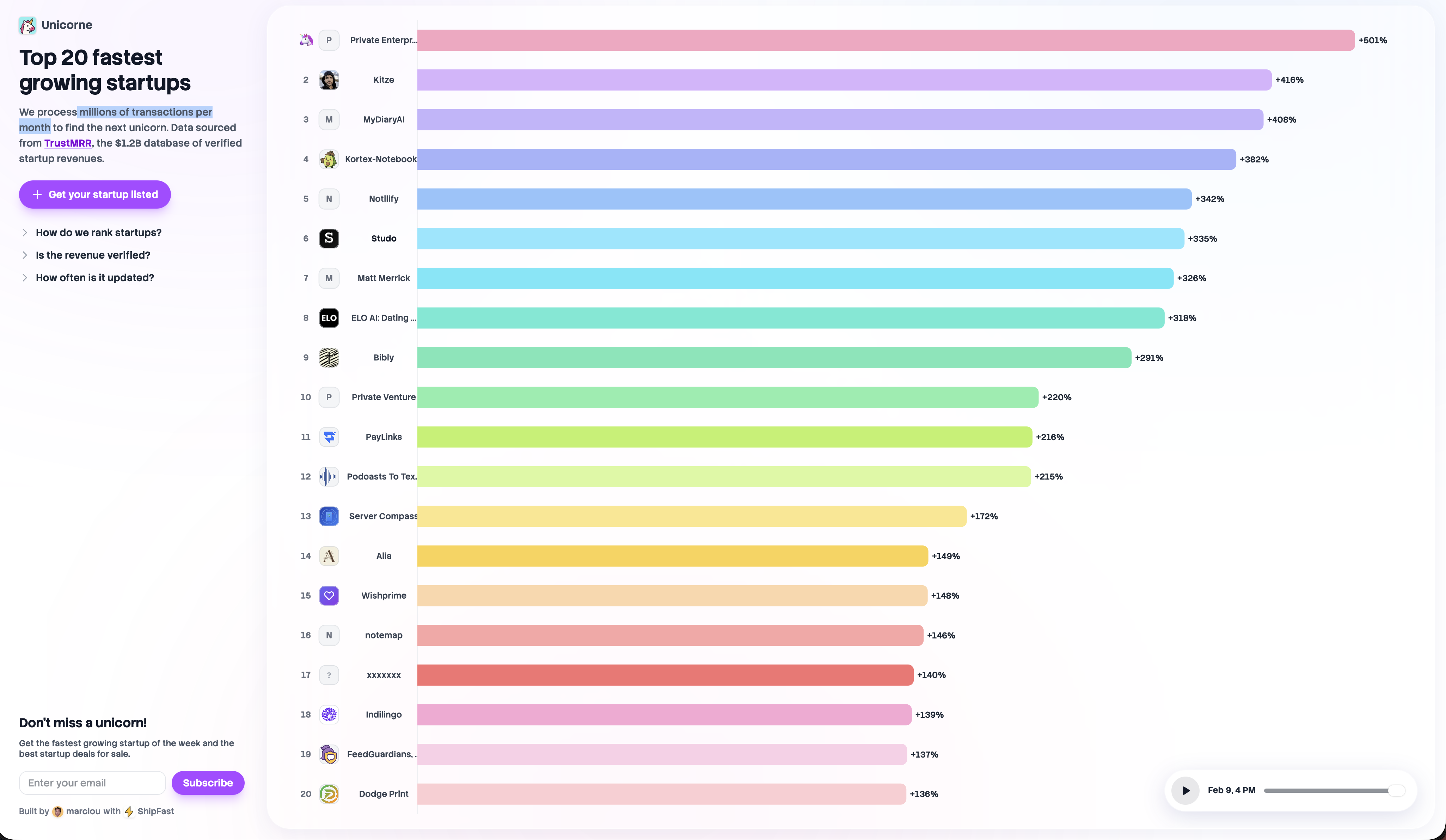

Rankings recalculate hourly, showing the top 20 fastest-growing startups across 7-day, 30-day, and 90-day windows. The site also compares recent performance against historical baselines, so you’re not just seeing absolute revenue but acceleration. That’s the right thing to measure.

The data pipeline flows through TrustMRR, which appears to be the underlying infrastructure aggregating payment provider data before Unicorne surfaces it as a leaderboard. That matters because it means Unicorne is partly a distribution layer sitting on top of someone else’s data layer. Not necessarily a weakness, but a dependency worth keeping in mind.

Marc Lou built this, the same person behind ShipFast in the indie hacker world. He used his own boilerplate, which tells you something about build speed and target audience. This is a product made by someone embedded in the micro-SaaS and bootstrapped founder community, for that same community. The newsletter angle, “get the fastest growing startup of the week,” suggests the real retention mechanism isn’t the live dashboard. It’s the email list.

It got solid traction on launch day. The engagement ratio between comments and votes was a little low, which might mean the core audience upvoted but didn’t have strong opinions or didn’t have questions. I find both interpretations interesting.

The obvious thing the product doesn’t fully answer yet: how many startups are actually in the pool? A leaderboard of 20 drawn from 40 is a very different product than a leaderboard of 20 drawn from 4,000.

The Verdict

Unicorne is doing one thing that genuinely matters. It’s replacing vibes-based startup status with verified payment data, and doing it in a clean, watchable format. That’s real, and credit where it’s due.

But the product’s credibility is entirely load-bearing on the TrustMRR data pipeline, and I don’t have enough visibility into how large or representative that dataset actually is. If the participating startup pool is small, the leaderboard stops being a signal and starts being a curated highlight reel. Not worthless, but a different product.

At 30 days, the question is retention. Does anyone come back to check the rankings a second time, or does this function as a one-time novelty? At 60 days, it’s about pool size and whether more startups are opting in. At 90 days, if the newsletter list is growing and the rankings are genuinely shifting week over week, this has legs as a media property more than a SaaS tool.

What I’d want to know before fully endorsing it is simple: how many startups are currently in the dataset, and what does the opt-in process actually look like for them?

Until that’s clearer, I’d say genuinely promising for founders and operators who want a quick, honest read on what’s growing. Less useful if you need anything approaching market-wide coverage. Worth a bookmark. Maybe two.